The Origin of the ATA Carnet System

The ATA Carnet Convention on temporary imports was established in 1961 by the World Customs Organization with the aim of fostering global trade by mitigating the barriers created by diverse national customs regulations. In 1969, the U.S. Treasury Department designated the United States Council for International Business (USCIB) as the entity responsible for managing and operating the ATA Carnet system within the United States.

USCIB — The U.S. National Guaranteeing and Issuing Association

USCIB serves as the U.S. National Guaranteeing and Issuing Association for ATA Carnets, operating under a framework of conditions established by the World Chambers Federation, a division of the International Chamber of Commerce (ICC) based in Paris. ATA Carnets facilitate the temporary, duty-free importation of goods into participating countries, primarily for use in trade shows, as commercial samples, or as professional equipment.

Temporary Importation Options for Businesses

Temporary importation provisions offer valuable tools for companies seeking to showcase their products in foreign markets or for professionals requiring the temporary use of their trade equipment in another country. Several options exist for businesses considering temporary importation, including the ATA Carnet, Temporary Importation Bonds (TIBs), entry with duty drawback, and provisions within free trade agreements.

You can read more about customs bonds in our article: “Top 7 Things You Should Know About Customs Bonds in 2024”.

The ATA Carnet system is widely recognized as the most user-friendly system for temporary import, with acceptance in approximately 80 countries. The list of participating countries is continually expanding, therefore, it is crucial to verify with ATA Carnet service providers such as Atlantic Project Cargo that the intended destination country accepts the Carnet.

For countries that do not currently accept the ATA Carnet, companies may utilize Temporary Importation Bonds (TIBs) or apply for duty drawback as an alternative means to achieve duty-free importation. Consulting with us is recommended to determine the most suitable option for specific circumstances.

What is ATA Carnet?

The ATA Carnet, also known as the “Merchandise Passport” or “Passport for Goods,” is an international customs document that enables the temporary importation of goods into participating countries on a duty-free and tax-free basis, regardless of whether they are shipped or carried by hand. The ATA Carnet system was established through the International ATA Conventions and is administered by the World Customs Organization and the World Chambers Federation of the International Chamber of Commerce. The primary meaning of ATA Carnet is to encourage global trade and mitigate trade barriers arising from diverse national customs regulations. The acronym “ATA” derives from the French and English terms “Admission Temporaire/Temporary Admission.”

The U.S. Customs and Border Protection (CBP), formerly known as the Bureau of Customs, has designated the U.S. Council for International Business (USCIB) as the National Guaranteeing Association (NGA) and Issuing Association (IA) for ATA Carnets in the United States.

Companies are required to present the ATA Carnet to customs upon departure from the United States and both entry into and exit from foreign countries. Upon their return to the United States, holders must again present the Carnet to CBP for duty-free re-entry. Furthermore, the ATA Carnet serves as the official registration of goods within the United States, eliminating the necessity for a U.S. Customs and Border Protection Certificate of Registration (Form 4455).

The ATA Carnet encompasses a diverse range of goods and merchandise, including, but not limited to, commercial samples, professional equipment, and exhibits for trade shows. However, it is important to note that consumables and disposable items are not eligible for coverage under an ATA Carnet. Moreover, it’s utilization is generally not advisable in instances where there is a possibility of selling a portion of the goods abroad.

The ATA Carnet is particularly advantageous when goods may be transported to multiple countries before being returned to the United States. Carnets are valid for up to one year, with the possibility of a one-year extension.

Proper Carnet Usage and Procedures

Improper use of an ATA Carnet can result in the assessment of duties, taxes, and penalties. To mitigate this risk, adhere strictly to the rules governing Carnet usage before your departure. Alternatively, ensure that your authorized representatives, customs brokers, or freight forwarders handle shipments in accordance with these prescribed guidelines.

Before departing or shipping your goods consult with Atlantic Project Cargo experts for any known restrictions or recommendations specific to the destination country.

Carnet Components and Usage

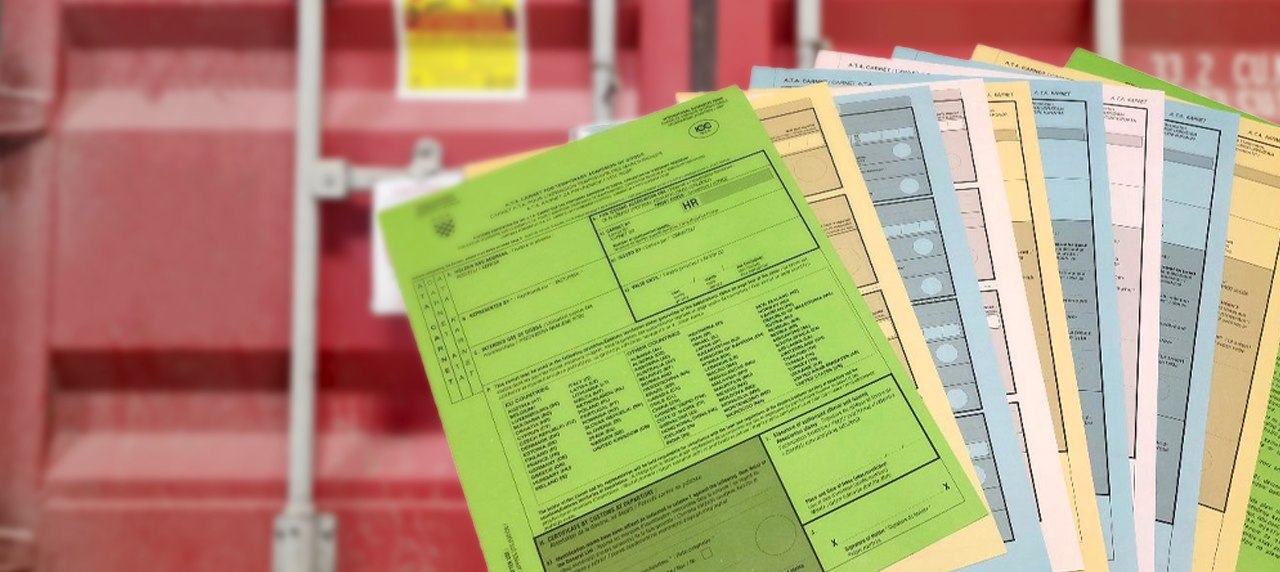

The ATA Carnet comprises green covers (front and back) and a set of counterfoils and vouchers.

Front Green Cover

Foreign customs authorities may deny entry of goods if the front green cover is not signed by the Holder or an authorized representative and validated by U.S. Customs for initial departure.

Back Green Cover

Contains essential notes on the use of the Carnet.

Counterfoils and Vouchers

Counterfoils and vouchers function as control documents.

- Counterfoils – Retained by the Carnet Holder

- Vouchers – Retained by customs authorities

Counterfoils and vouchers are issued in pairs and are color-coded for specific purposes.

Yellow

Used for exiting the U.S. and returning to the U.S. (No yellow vouchers are issued.)

White

Used for entry into and departure from foreign countries.

Blue

Used for transits. Transits are typically necessary when merchandise is transported by land and must pass through or stop in a country situated between the country of departure and the next country of entry (e.g., traveling from Germany to Italy while passing through or stopping in Switzerland).

It is imperative to utilize all sets of counterfoils and vouchers in numerical sequence. For instance, the first set used for entering and exiting a foreign country should be numbered “No. 1,” the second set “No. 2,” and so on.

Key Benefits of the ATA Carnet

Duty and Tax Exemptions

Eliminates the payment of import duties and value-added taxes (VAT) in participating countries.

Simplified Customs Procedures

Streamlines customs processes by providing a single document for all customs transactions, enabling pre-arranged customs formalities, and offering predetermined costs.

Flexibility for Multiple Entries/Departures

Allows for unlimited entries and departures within a one-year validity period.

Facilitated Re-entry into the U.S.

Eliminates the need to register goods with U.S. Customs and Border Protection (CBP) upon departure.

Reduced Export Documentation

Eliminates the requirement for an Electronic Export Information form (formerly Shipper’s Export Declaration), except for exports requiring an export license.

Elimination of Temporary Importation Bonds (TIBs)

Avoids the need to post Temporary Importation Bonds.

Procedures for Using an ATA Carnet

Departing the United States

Initial Departure

The Holder or an authorized representative must sign the green cover. U.S. Customs will then validate the green cover and a yellow exportation counterfoil to activate the Carnet for its first use.

Note

U.S.-issued Carnets do not utilize exportation vouchers.

Foreign Customs Requirements

Foreign customs authorities may deny entry of goods if the green cover or the exportation counterfoil is not validated by U.S. Customs.

Using the Yellow Exportation Counterfoil

Use the yellow exportation counterfoil (No. 1 for initial departure). Section (1) of the counterfoil, indicates only the item numbers being exported from the United States.

Holder Responsibility

It is crucial for the Holder to ensure that U.S. Customs accurately reflects the correct item numbers on the counterfoil, particularly in cases of partial or split shipments.

Presenting to U.S. Customs

Present the Carnet to U.S. Customs for inspection.

U.S. Customs Validation

U.S. Customs will validate the counterfoil.

Entering a Foreign Country

Using the White Importation Voucher

Utilize a white importation voucher. Complete Sections D and E of the voucher. Section F(a), indicates only the item numbers entering the country. In Section F(b), specify the intended use of the Carnet (e.g., participation in an exhibition or sales visit).

Signing and Presenting

Sign and date the voucher. Present the Carnet to customs officials upon entry.

Foreign Customs Procedures

Foreign customs will indicate only the entering item numbers in Section (1) of the counterfoil.

Time Limits

Customs authorities may restrict the duration of a shipment to less than one year. Ensure strict adherence to the “Final Date for Re-exportation/production to the Customs of goods” specified in Section 2 of the counterfoil. If no restrictions are imposed, the final date for re-exportation defaults to 12:00 midnight on the expiration date (c) printed on the green cover.

Customs Inspection and Validation

The customs inspector will validate both the counterfoil and voucher and then detach the voucher.

Departing a Foreign Country

Using the White Re-exportation Voucher

Utilize the white re-exportation voucher corresponding to the most recently used importation voucher. Complete Sections D and E. Section F(a), indicates only the item numbers leaving the country and the corresponding importation voucher number. Complete Sections F(b), F(c), and F(d) as applicable.

Signing and Presenting

Sign and date the voucher. Present the Carnet to customs officials upon departure.

Foreign Customs Procedures

Foreign customs officials must clearly indicate the item numbers leaving the country in Section 1 of the counterfoil, along with the corresponding importation voucher number.

Note

If any items are not re-exported and duties are paid, obtain a customs cashier’s receipt from local customs authorities. This receipt must clearly list the non-re-exported merchandise (as per the General List) and include the Carnet number. The Carnet and receipt must be returned to USCIB upon final Carnet use.

Customs Validation and Voucher Detachment

Foreign customs will validate both the counterfoil and voucher and then detach the voucher.

Special Note

Customs authorities within the European Union (EU) may be reluctant or unable to validate ATA Carnets for goods moving between EU member states. It is crucial to insist on validation of both the re-exportation counterfoil and voucher before final departure from the EU.

Consequences of Improper Usage

Failure to Re-export

All items not re-exported due to loss, theft, destruction, or other reasons are subject to applicable duties, taxes, and potential penalties.

Lack of Validation

Carnet Holders who fail to obtain proper customs validation upon departure from a foreign country may be subject to regularization fees imposed by foreign customs authorities, even in the absence of a claim.

Re-Entering the United States

Customs Declaration

Upon re-entering the United States, present the Carnet to customs officials at the port of first arrival.

Using the Yellow Re-importation Counterfoil

Utilize the yellow re-importation counterfoil corresponding to the yellow exportation counterfoil used at the time of departure.

U.S. Customs Procedures

The U.S. Customs inspector will clearly indicate the re-entering item numbers in Section 1 of the counterfoil and the corresponding exportation counterfoil number in the second part of Section 1. Customs will then validate the counterfoil.

Note

U.S. Customs generally permits goods to re-enter the United States even if the Carnet has expired. The expiration date only limits entry into foreign countries.

Importance of U.S. Customs Validation

It is crucial to obtain U.S. Customs validation of the re-importation counterfoil upon return. This validation serves as the final safeguard in canceling the Carnet or settling any claims without incurring duties and taxes, although regularization fees may still apply.

Returning the Carnet to USCIB

Carnet Ownership

The Carnet remains the property of USCIB.

Returning the Carnet

Upon completion of the final trip, return the ORIGINAL Carnet, along with all used and unused certificates, to the designated Carnet Service Provider.

Retaining a Copy

Make a copy of all Carnet pages for your records.

Carnet Service Provider Address

The address of the Carnet Service Provider can be found at the bottom of both the front and back of the Carnet’s green cover.

Conclusion

In conclusion, the ATA Carnet offers a streamlined approach to temporary import, minimizing customs delays and associated costs. By leveraging the ATA Carnet system, businesses can facilitate the smooth movement of goods across borders for exhibitions, trade shows, and other temporary purposes.

Atlantic Project Cargo can assist throughout the entire process, providing guidance on ATA Carnet applications, securing Temporary Importation Bonds (TIBs), navigating customs clearance procedures, and managing all aspects of your international shipping needs. Contact us today to learn how we can help you optimize your global logistics operations.

FAQ

Carnet processing fees are determined by the value of the goods listed on the Carnet.

If the application and security deposit are received by 4:00 PM ET, the processing time for a Carnet application is typically two business days.

In the event of losing the Carnet document, contact the ATA Carnet service provider that issued the original Carnet to obtain a duplicate.

The ATA Carnet is not recommended for goods intended for sale.

Penalties for Selling Goods

If any goods covered by an ATA Carnet are sold, penalties will apply. These penalties include:

- A penalty equal to 10% of the amount of duties and taxes that would have been owed

- Payment of duties and taxes for the sold goods

- A potential USCIB claims handling fee

Contacting Local Customs

For goods sold under an ATA Carnet, it is necessary to contact the local customs office to determine the appropriate procedures.

Country-Specific Regulations

Some countries, such as the United Kingdom and Australia, have strict regulations regarding the sale of goods covered by ATA Carnets.

General Procedure

Generally, local customs will require that the goods and the ATA Carnet be brought to their office before the Carnet’s expiration date. This allows for the proper discharge of the Carnet and the payment of applicable duties, taxes, and penalties.

Read More