Car import into the U.S. can be challenging with potential pitfalls: laws, requirements, and paperwork. However, with the right guidance and understanding of the process, it can be a straightforward endeavor. Whether you are considering bringing in a truck, a motorcycle, or a modern racing car, knowing the ins and outs of United States car import laws is crucial.

This article outlines the key steps for successfully importing your vehicle into the United States. It covers compliance with safety and emissions standards, taxes, and how to navigate customs procedures to make your import experience smoother.

Check if Your Car Meets the Necessary Import Requirements

Before you begin the car importing process, verify that your vehicle is eligible for importation into the U.S. Generally, vehicles must comply with standards set by:

- The U.S. Department of Transportation (DOT). It focuses on safety standards

- The Environmental Protection Agency (EPA). The EPA requires vehicles to meet specific emissions standards

To determine your vehicle’s eligibility for import into the United States, it’s essential to ensure that both EPA and DOT labels are affixed.

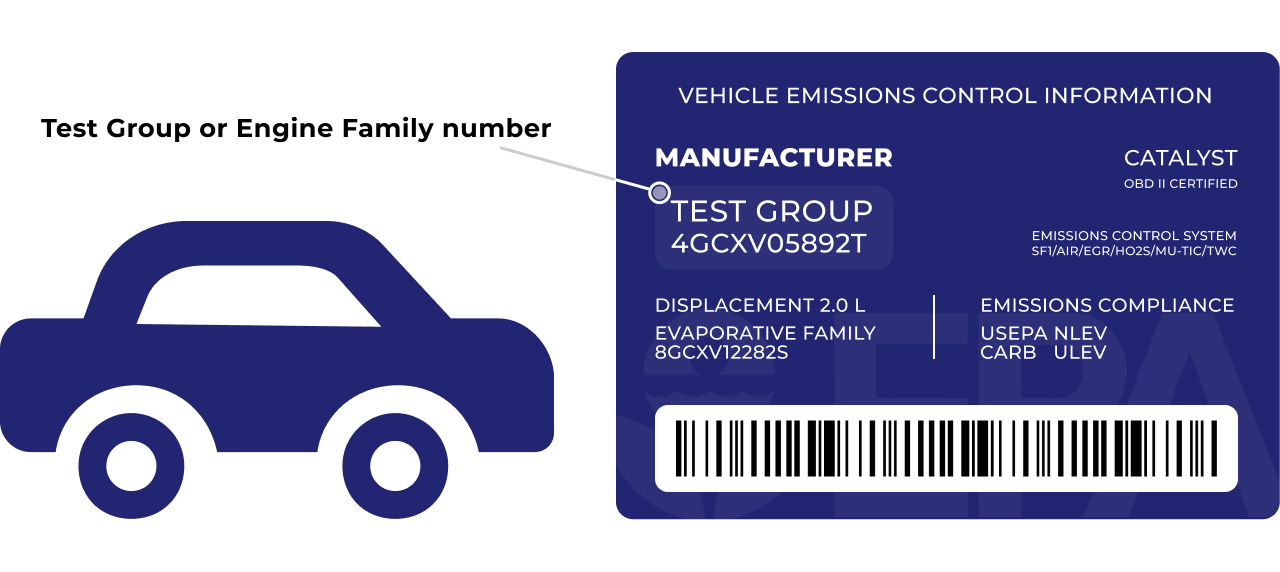

EPA Vehicle Emissions Label

The EPA vehicle emissions label is typically found under the hood or in the engine compartment of light-duty vehicles and trucks. Motorcycles and motor scooters have the sticker, located in an accessible place, e.g. under the seat or on the frame. As for heavy-duty vehicles, their label is located on the engine’s block.

EPA emissions label provides crucial information, including the manufacturer’s name, trademark, type of fuel used, miles-per-gallon rating, fuel consumption levels, etc. Additionally, this sticker includes a clear statement of compliance with EPA emission regulations.

The EPA set the following emission standards:

- Gasoline-fueled cars and light-duty trucks originally manufactured after December 31, 1967

- Diesel-fueled cars originally manufactured after December 31, 1974

- Diesel-fueled light-duty trucks originally manufactured after December 31, 1975

- Heavy-duty engines originally manufactured after December 31, 1969

- Motorcycles with a displacement of more than 49 cubic centimeters originally manufactured after December 31, 1977

For cars older than 21 years, EPA compliance is not required. However, if your car does not meet U.S. emission standards, it must be imported through an Independent Commercial Importer (ICI). It is a company that has received permission from the EPA to legally import cars into the country. They also modify, test, and certify your car so it meets the required standards. Be aware, that because of all these additional modifications ICI fees can be quite substantial.

The list of approved entities is here.

But keep in mind that the ICI import authority is usually limited to certain car makes and models. Before you arrange your import, contact your ICI. Confirm that it can import your specific auto. Additionally, ICI designation does not guarantee approval of the ICI’s treatment of an imported car. The EPA will closely examine the ICI’s test documentation. They will also review the information about the quality of modifications. This is to ensure your car meets all applicable requirements under import regulations.

DOT Certification Label

The Department Of Transport (DOT) does not allow cars that do not meet all applicable Federal Motor Vehicle Safety Standards (FMVSS). All the regulations are listed on this page of the National Highway Traffic Safety Administration (NHTSA) website.

Cars made to meet FMVSS have a certification label on the driver-side door. Motorcycles have the label near the steering post and handlebars. The label must contain the following information:

- The car’s manufacturer

- The date of manufacture

- The Gross Vehicle Weight Rating (GVWR)

- The Gross Axle Weight Rating (GAWR) of each axle

- The vehicle type classification (e.g., passenger car, truck, bus, motorcycle, etc.)

- The car’s Vehicle Identification Number (VIN)

To simplify importation, buyers should ask sellers to confirm in the sales contract that the label is attached. This document should be presented during importation.

This label also allows Customs and Border Protection (CBP) to approve the car’s importation.

If your car does not have the certification label, it is non-conforming. In this case, the importer must collaborate with a Registered Importer (RI) and modify your auto. It is necessary to complete all the safety upgrades for admissibility.

RI is a company approved by NHTSA to import cars that were not originally made to comply with FMVSSs. RI is also allowed to perform necessary modifications to bring the autos into conformance. The list of Active Registered Importers is here.

Vehicles older than 25 years are exempt from DOT compliance. It’s essential to understand that the 25-year rule refers to the car’s manufacturing date, not its model year. If the auto’s date of manufacture is not seen on a label from the original manufacturer, you need other documentation to prove its age. This must include an invoice showing when the vehicle was first sold. A registration document showing the vehicle was registered at least 25 years ago is also acceptable. If you don’t have this information, a statement from a recognized vehicle historical society can help identify the car’s age.

Also, it is advisable to confirm the specific regulations and documentation necessary for importing a car under the 25-year rule. Additionally, it’s a good idea to consult local authorities or a shipping company like Atlantic Project Cargo. We can assist with the entire vehicle import process

Personal Use Exemption

If your vehicle lacks both the EPA and FMVSS labels, you can still import it under the ‘Personal Use’ exemption. To do this, you must obtain a Certification of Conformity (CoC) from the car’s manufacturer. You must present this document to U.S. Customs upon arrival at the border.

How to get a CoC:

- Go to the page of EPA’s Transportation and Air Quality Document Index System

- In “Compliance Document Type” choose “Certificates of Conformity”

- Then choose the industry, model year of your car, and then appropriate manufacturer

- Type in the vehicle model

- Skip the “Keyword Search”

- Click on the “Search” button

- Save and/or print the PDF file

If you need a CoC for a car with a model year before 2003, send the following information to EPA’s Imports Hotline:

- Model year of the car

- Manufacturer of the car

- Car model

- Test Group number (only applies to light-duty cars and trucks – model year 2001 or later) or Engine Family number (only for pre-2001 light-duty cars and trucks, and non-road and heavy-duty engines/vehicles). The number has 11 characters of both letters and numbers. It is found on the Vehicle Emissions sticker

- Your name

- Contact information (address, email address, or fax number where you want EPA to send the Certificate of Conformity)

EPA’s Imports Hotline: [email protected], phone: 734-214-4100, fax: 734-214-4676.

Declare your car import as 2B on Form HS-7. If you declare it as a commercial shipment without the necessary labels, your auto will be denied entry.

Substantially Similar Rule

The Substantially Similar Rule allows vehicles that closely resemble already certified models in the U.S. to be imported without full testing. This simplifies the process for cars that meet U.S. safety and emissions standards.

However, “substantially similar” can be subjective and interpreted differently. The NHTSA and EPA assess whether a foreign car meets this standard by evaluating safety, emissions, and other specifications.

This rule might be helpful for those who do not know how to import European cars to the U.S. However, importers must still comply with all customs and import laws and regulations.

How Much Would It Cost to Import a Car

The cost of importing a car can vary widely based on several factors, including:

Customs duties and taxes. Import duty rates for foreign-made cars are:

- 25% for cars

- 25% for trucks

- 2.4% for motorcycles

The duty rates are based on the price paid for the vehicle at the time of purchase. They do not depend on whether the car was new or used, or whether it is private or commercial.

There are specific circumstances under which a foreign car may be imported without incurring duties. They are:

- U.S. citizens working abroad return for a brief visit. They should claim nonresident status and export the vehicle upon departure

- Non-residents may bring in a car for personal use for up to one year

- Vehicles eligible under the USCMA agreement

- Cars that have been exported within the last three years, provided they have not undergone any enhancements or modifications to increase their value

Also, a Customs Bond is required for each imported vehicle. There are two types of this bond: Single-Entry (for one-time imports) and Continuous (for multiple imports within a year).

DOT Bond. It is required for vehicles that are imported as nonconforming. The bond’s value in this case must be 1.5 times the vehicle’s dutiable value.

Gaz-Guzzler Tax. The amount of this tax depends on a combined fuel-economy rating (miles per gallon) established by the EPA. The higher this rating, the lower the tax. Vehicles with an MPG rating of more than 22.5 miles per gallon are not taxed.

In addition to import car taxes and duties, you will also have to pay for insurance and vehicle registration. If your vehicle needs adjustments to meet U.S. standards do not forget to pay for modification. The method of transportation will also affect the price of importing a car.

If you need help with documentation and other necessary things for your vehicle importation, use the custom brokerage services from Atlantic Project Cargo.

Decide Which Transportation Method is the Best for You

To bring your vehicle into the U.S., the owner must organize the shipping process. The first port of entry will handle customs clearance. So it is important to determine which transportation option best suits your needs.

Land transport

If you are importing a vehicle from Mexico, or any other country within the same continent, you can opt to drive your car across the border yourself. Or you can hire a commercial carrier for transport. Upon reaching the border, Customs and Border Protection (CBP) will inspect the vehicle. If everything checks out, it can be admitted into the U.S.

Ocean freight

Shipping by sea is the most widely used method for transporting vehicles, particularly from Europe or Asia. This is usually achieved through Roll-On and Roll-Off (RORO) shipping. After selecting your port of entry, you can initiate the shipping process. Be aware that it may take several weeks or even months. It is important to note that vehicles shipped via ocean freight require an Importer Security Filing.

Air freight

You can also import your car at the airport. Air freight is the quickest, yet also the priciest transportation method. This option is the best if you need to import your vehicle urgently.

Obtain All the Necessary Import Documentation

Proper documentation is vital for an unproblematic import process. Essential documents include:

- A U.S. Customs Proforma Invoice

- The carrier’s Bill of Lading (BOL)

- Bill of Sale showing VIN

- Foreign Registration

- A copy of the Vehicle Registration

- EPA Form 3520-1 (for On-Road vehicles) or 3520-21 (for Off-Road vehicles)

- DOT Form HS-7

- Importer Security Filing (if shipping by sea)

- A USMCA/CUSMA Certificate of Origin (if applicable)

- Letter of Recall Clearance (for Canada Import)

Make sure that all the documentation you collect is complete and accurate to avoid delays, failures, and other unpleasant situations. We recommend you hire our car import broker to help you file documentation.

Have Your Car Cleaned Before an Import

Before shipping, it’s essential to have your car steam-sprayed or thoroughly cleaned, especially the tires and undercarriage. This step helps to prevent the introduction of foreign soil and pests into the country. It also makes the inspection process smoother, as customs officials are more likely to flag dirty vehicles for additional scrutiny.

Be Ready for an Inspection

Inspections play a crucial role in the import process, as they confirm that your car meets all safety and emissions standards. During the inspection, a technician will verify that the essential components of your car are properly installed and that any required equipment is functioning correctly. Additionally, the inspection will ensure that your tires match those specified on the manufacturer’s sticker and that the odometer reading aligns with the title. To register your car in the United States, you may also need to pass an emissions test.

To improve the chances of your vehicle passing the inspection, consider the following tips:

- Prepare all necessary paperwork in advance

- Remove any personal belongings from your vehicle

- Clean your car thoroughly, paying special attention to the tires and undercarriage

Also, take into account that it is forbidden to use your car as a storage space for shipping goods. Any contents must be declared to customs, which could lead to seizure or additional fees.

Arrange for License Plates and Registration

Once U.S. car importer passes the inspection, they should reach out to their local Department of Motor Vehicles (DMV). This is necessary to secure temporary license plates and get clarification on the specific documentation required.

After U.S. Customs confirms that your car meets EPA and DOT standards, you will need to register your car. Complete and submit the following forms to your state’s DMV: 7501, 3461, DOT Form HS-7, EPA Form 3520-1. The process for obtaining plates and permits may vary by state, but generally, you will need to:

- Apply for a permanent vehicle registration

- Provide proof of insurance for your car

- Pay any applicable taxes and fees related to registering a new automobile (these fees vary by state)

- Obtain license plates, which can be purchased from your local DMV office

- Acquire all necessary permits, for example, a license plate sticker

Import to the U.S. For a Short Amount of Time

If you plan to import your automobile temporarily (for example, for a vacation), you may need to apply for a temporary import permit. This permit allows you to use the vehicle in the U.S. for a limited time without the full import process. Ensure you understand the specific requirements and limitations of temporary imports.

Conditions under which it is allowed to import vehicles without being brought into compliance with any standards:

- Non-U.S. citizens are permitted to import a car for a duration of one year. During this time, the auto cannot be sold. And if it is not brought into compliance by the end of the year, it must be exported. Importantly, there are no exemptions or extensions to the export requirements

- Automobiles imported for research, investigation, demonstration, training, or racing can be allowed without full compliance with U.S. vehicle regulations. However, they cannot be used on public roads except when necessary for testing. Additionally, the importer must submit EPA Form 3520-1 and DOT Form HS-7 upon entry

- Authorized foreign diplomats or armed forces members may temporarily import a non-conforming vehicle into the U.S. However, the car must be exported upon the completion of their tour of duty

- A non-conforming car that is intended for export must be marked “for export” on both the vehicle or engine and its container. This designation must also appear on the DOT Form HS-7

Customs Clearance Guide

Download your copy today and: • Navigate customs with confidence • Save time and money • Stay compliant

Stop the guesswork, start streamlining your imports and exports. Download your free guide now!

Download nowConclusion

Importing automobiles into the U.S. can be a complicated endeavor due to the multitude of regulations and requirements involved. By following the steps mentioned in this article and staying informed, you can successfully navigate the car importation process.

Atlantic Project Cargo provides comprehensive support throughout the entire import process. We offer experienced vehicle import brokers and provide you with import documentation that meets all necessary requirements.

Read More

Victoria Moseicuka

Victoria Moseicuka

Victoria Moseicuka

Victoria Moseicuka

Victoria Moseicuka

Victoria Moseicuka