Key Takeaways

- Customs clearance is the process of getting government approval to transport goods across borders. It involves submitting documents, paying duties, and following customs regulations

- Common challenges include mistakes in documents, high taxes, regulatory complexity, inspections, restricted goods, exchange rate changes, and technical issues

- To prevent delays, the importer must prepare documents in advance, provide clear goods descriptions, and declare accurate values. They must also work with a trusted logistics partner and customs broker

- Our free online tool simplifies the process of import duty calculation

Navigating customs clearance is a complex process. However,it is a crucial step for ensuring the smooth movement of goods across borders. This article explores the custom clearance meaning, its main stages, the parties involved, common challenges arising during the process, and how to deal with them. We will also explain how to calculate import duties quickly and answer the most popular questions.

Importing and exporting goods to the USA and Canada can be complicated, especially due to regulations. Atlantic Project Cargo’s customs clearance services make imports easy and stress-free. Our licensed customs broker will assist you during the process.

Get a Free Quote!

What is Customs Clearance?

Customs clearance is the process of getting permission from authorities to move goods across international borders. It involves submitting the necessary documentation, paying applicable duties and taxes, and ensuring compliance with all import or export regulations.

Import customs clearance is a critical step in international trade for the following reasons:

- Legal compliance

Ensures adherence to national and international trade laws - Revenue collection

Duties and taxes collected during clearance contribute to government revenue - Security

Prevents the movement of illegal or dangerous goods, e.g., drugs, weapons, counterfeit items - Trade facilitation

Streamlines the movement of goods, supporting global commerce

In general, customs clearance involves the following parties:

- Importer or exporter – the entity shipping or receiving the goods

- Customs authorities – government agencies responsible for enforcing trade regulations

- Carriers – shipping companies or logistics providers transporting the goods

- Customs broker – a licensed professional who assists with the clearance process

Main Steps of Customs Clearance

In general, the process can be broken down into three key stages.

Before Arrival

Before goods reach the border or national clearance hub, some steps must be completed to start the process:

- Preparing documents

Importers or exporters need to gather and submit important papers like invoices, packing lists, and certificates of origin - Sending shipment details in advance

Many countries require shipment details to be sent via the Internet before arrival. This helps officers check the goods faster - Checking compliance

Authorities may review documents before the arrival to ensure goods meet rules on product standards, licenses, and trade restrictions

When Goods Arrive

When goods reach the port, airport, or border, the customs clearance processing starts.

- Inspection

Officers check the goods to confirm their type, quantity, and value - Calculating taxes and fees

Authorities decide how much duty and tax needs to be paid based on the value and type of goods - Risk assessment

Some shipments are checked more closely if they seem risky, based on the type of goods, trading history, or other factors

After Clearance

When customs are cleared, some final steps are required:

- Releasing the goods

Once cleared, they are sent to the importer’s location. Authorities may issue a clearance certificate - Keeping records

Importers must keep records of all documents, taxes, and fees paid in case of future checks - Customs audits

Authorities may review past shipments to ensure everything was reported correctly. If errors are found, extra fees or penalties may apply

How to Calculate Import Duties Quickly and Easily

Calculating import duties can be confusing. Our customs clearance company will help you navigate complexities and ensure you pay the correct amount of duty. Just use our free calculator.

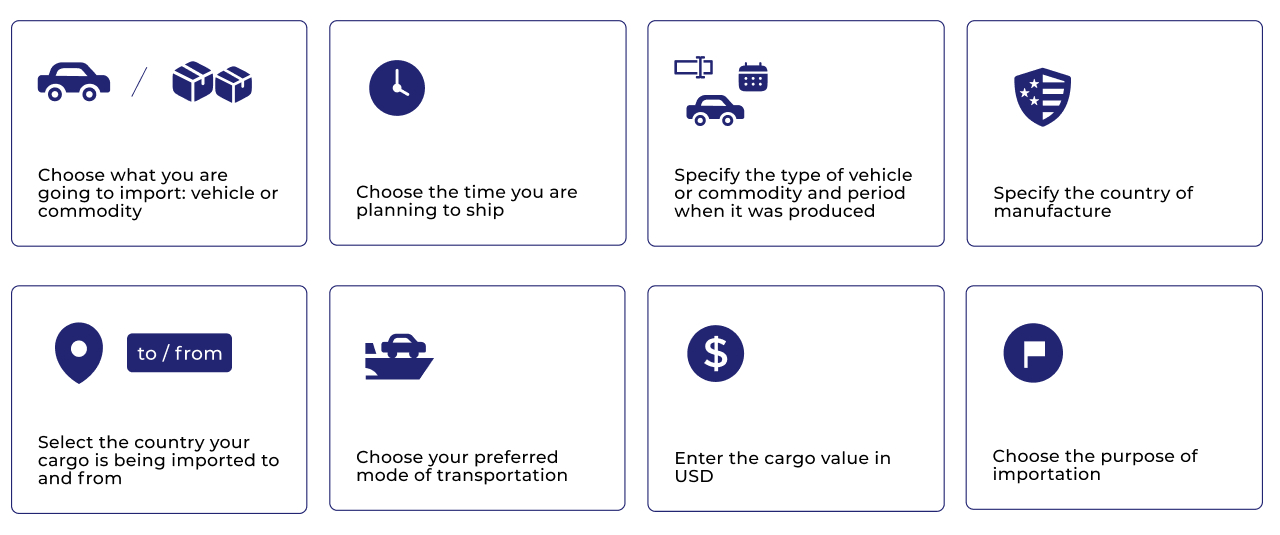

Detailed Instructions for Using the Calculator

All you have to do is follow the link and enter the following information:

You will receive a detailed calculation of import duties in just ten simple steps.

Calculate Import Duty in Minutes!

Common Challenges Arising During Customs Clearance Process

This process can involve several issues that cause delays and increase costs. Here are some common challenges:

- Missing or incorrect documents

If forms are incomplete or have errors, authorities may delay the shipment. Double-checking paperwork helps avoid these problems - High taxes and fees

Wrong classification or valuation of goods can lead to high costs. Properly declaring goods can prevent extra charges - Complicated rules

Each country has different trade laws, which can be hard to follow. Staying informed helps avoid mistakes and delays - Customs inspections

Some shipments are randomly checked or inspected due to suspicion. Well-organized packaging and accurate documents can speed up this process - Communication issues

Delays in talking to officials can slow things down. Clear and quick communication helps solve problems faster - Restricted or banned goods

Shipping items not allowed in a country may result in confiscation or return. Checking import rules in advance prevents this - Changing exchange rates

Currency fluctuations can affect the total cost of duties and taxes. Planning ahead can reduce financial risks - Technical problems

System failures or errors in electronic submissions can cause delays. Ensuring correct filings and having backup plans can help

Tips to Prevent Delays

These recommendations will help you avoid delays during the customs clearance process.

Follow Country-Specific Regulations

Each country has unique import laws. Some require special permits or extra paperwork. If these steps are done incorrectly, your shipment could be delayed.

For example, the US Environmental Protection Agency (EPA) has strict emissions regulations for imported heavy equipment like excavators, bulldozers, and tractors. The importer must modify any non-compliant machinery to meet Tier 4 emission standards.

Prepare Documents in Advance

Have all necessary papers ready before shipping. Ensure they are accurate and complete. Key customs clearance documents for importing to the US include:

- Bill of Lading (BOL) or Air Waybill (AWB)

A transport document issued by the carrier, confirming the shipment details and ownership - Commercial Invoice

A document from the seller detailing the goods, their value, and the terms of sale (used for customs valuation) - Packing List

A detailed list of the cargo, including weight, dimensions, and packaging type - Importer’s Customs Entry (CBP Form 7501)

The Entry Summary Form submitted to US Customs and Border Protection (CBP) for customs clearance - Customs Bond

A financial guarantee required for shipments valued over $2,500 or those subject to special regulations - Certificate of Origin (COO)

A document verifying the country of manufacture, which may be needed for tariff benefits under trade agreements - HS Code Classification

The Harmonized System (HS) Code for imported goods, used to determine duties and regulations

Note that specific imports may require additional documentation, especially for goods subject to regulations by other government agencies.

Provide a Clear Goods Description

Describe your goods accurately on the commercial invoice. This helps customs classify the shipment and determine taxes and duties.

Be specific — include quantities, unit prices, HS codes, and the country of origin.

State the Correct Value of Your Goods

Authorities calculate duties and taxes based on the declared value. You must report the actual price paid by the buyer and provide proof of payment.

Explain Why You are Shipping the Goods

Stating the reason for shipping (e.g., resale, samples, gifts) can help reduce charges or qualify for lower duty rates.

Ensure Consistent Information

Differences in paperwork, such as mismatched values, descriptions, or product codes, can cause delays. Therefore, it is important to check carefully that all details match across documents.

Work With a Trusted Partner

Importing and exporting goods can be challenging, and dealing with customs rules can make it even harder. A reliable logistics partner like Atlantic Project Cargo understands international shipping laws and can help smooth the process.

Calculate Import Duty in Minutes!

FAQ

The time required for customs clearance completion depends on various factors. They include the complexity of the shipment, processing volume, and the accuracy of the documentation.

A company handling customs procedures has received your shipment from an airport, seaport, or warehouse.

It means that a specialized company handling customs procedures has collected the shipment.

The authorities are currently inspecting and clearing your shipment.

The shipment is undergoing inspection, which includes reviewing documents, scanning, or a physical examination.

The shipment’s details, such as contents, value, and origin have been officially submitted to authorities for review.

It means that a shipment has passed all necessary checks and is free to move.

The following phrases have the same meaning:

- “shipment completed customs clearance process”

- “import customs clearance completed”

- “inbound out of customs”

- “left from customs”

- “cleared customs”

- “cleared import customs”

- “overseas import customs release”

- “your package has been released by the government agency”

It means that goods have successfully passed through customs, including all necessary inspections, documentation, and duties or taxes paid.

Your shipment has successfully passed through the customs process in the country of origin. The necessary documentation has been verified, and any required duties or export restrictions have been addressed.

Conclusion

Completing customs clearance requires careful preparation, attention to detail, and a clear understanding of regulations. By following the steps from this guide, you can simplify customs clearance. Also, you will avoid common pitfalls and ensure your cargo successfully moves across borders.

Read More