Key Takeaways

- Importing heavy machinery into the U.S. is a regulatory process, not just shipping. Admissibility must be confirmed before cargo moves to avoid fines, delays, or seizure

- EPA, DOT, and USDA compliance are critical. Emissions labels, safety standards, and mandatory steam cleaning for used equipment are non-negotiable requirements

- Year, make, and model alone do not guarantee compliance. Foreign-market versions of U.S. brands often fail to meet U.S. EPA or DOT standards

- USDA cleanliness inspections are a common cause of delays. Even trace amounts of soil can result in costly holds and re-cleaning at U.S. ports

- A structured, pre-shipment compliance review prevents costly mistakes. Verifying documentation and eligibility before export is essential

- Import costs include logistics and government-imposed fees. Duties, tariffs, bonds, and taxes can significantly impact total project cost

- Special tariffs may apply to machinery. Section 232 tariffs, the “chicken tax,” and other duties can add up to 25% or more

- The 25-year exemption can drastically simplify imports. Older machinery may qualify for EPA and DOT exemptions and reduced duties if filed correctly

- End-to-end project management reduces risk. Integrated customs brokerage, transport planning, and compliance expertise ensure smooth delivery

Importing heavy machinery into the United States is far more than a simple shipping order. For any business that relies on industrial equipment — whether for construction, manufacturing, or agriculture — a single machine can represent a massive capital investment.

But that investment is at risk if the import process is mishandled.

The challenge is a complex puzzle of regulatory compliance. A mistake in paperwork or a misunderstanding of a single rule can lead to costly delays, steep fines, or even the seizure and re-exportation of your equipment.

At Atlantic Project Cargo, we manage these high-stakes imports every day. This guide will walk you through the essential considerations for importing heavy machinery, powered equipment, or industrial vehicles into the USA.

It’s About Admissibility, Regulatory Bodies, and Safety Standards

The first and most critical hurdle is admissibility. Before your machinery leaves its origin port, you must be 100% certain it is allowed to enter the United States. U.S. Customs and Border Protection (CBP) acts as the gatekeeper, but it enforces the rules of several other powerful regulatory bodies.

For importing machinery and powered equipment, these three are key:

EPA (Environmental Protection Agency)

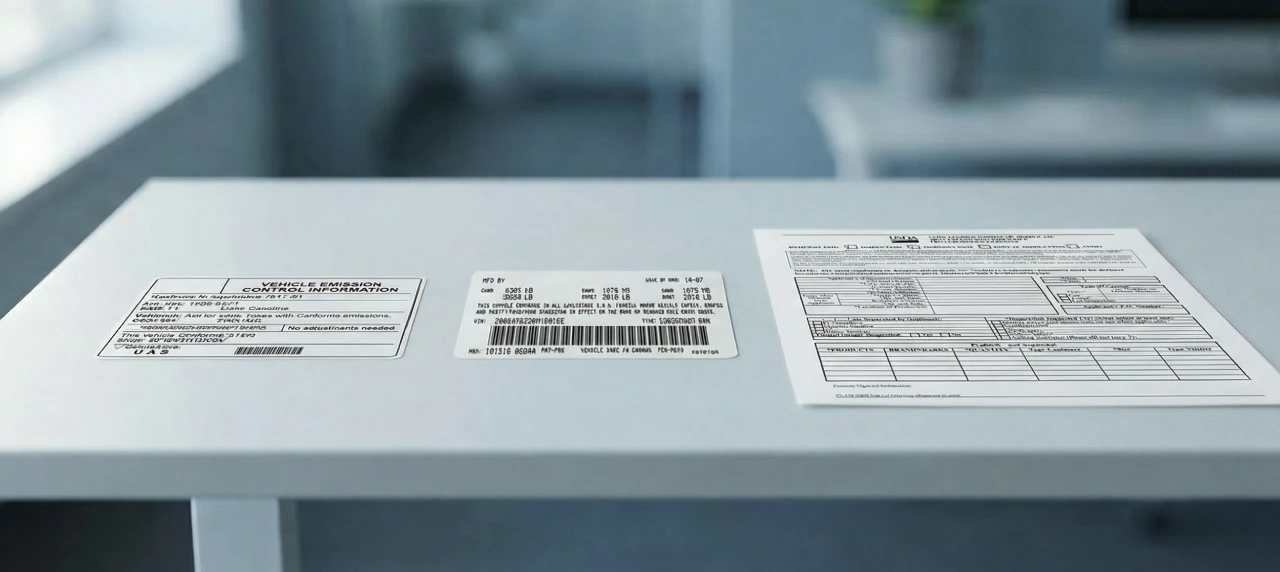

The EPA regulates emissions. Most powered equipment (especially with diesel or gasoline engines) must have a “Vehicle Emission Control Information” label. This label, usually found on the engine block or under the hood, must state that the engine conforms to U.S. EPA standards.

DOT (Department of Transportation)

The DOT regulates safety standards for any equipment that may go on a public road. This includes commercial trucks, mobile cranes, and even certain trailers. Proof of compliance is the Federal Motor Vehicle Safety Standards (FMVSS) sticker, usually located on the driver’s door jamb.

USDA (Department of Agriculture)

This is the one most importers forget. The USDA is concerned with preventing foreign soil and pests from entering the U.S. All used machinery, without exception, must be professionally steam-cleaned before shipping. If a USDA inspector finds even a small amount of soil on an excavator’s tracks or a tractor’s wheel well, your entire shipment will be put on hold for cleaning, leading to massive delays and fees.

Isn’t Year, Make, Model Check Enough?

No. This is a common, costly error– to assume that because a specific make and model (e.g., a Caterpillar excavator) is sold in the U.S., any foreign-market version is automatically compliant. This is false. A vehicle or machine built for the European or Asian market — even if originally made by a U.S. manufacturer —often does not meet U.S. EPA or DOT standards and may be inadmissible.

A 4-Step Project Plan for Successful Import of Heavy Machinery

While the regulations are complex, our process is designed for clarity. As your single point of contact, Atlantic Project Cargo transforms the import process into a manageable plan.

Step 1: Feasibility & Compliance Review

We don’t move cargo first and ask questions later. Our project begins with a full documentation and admissibility review. We verify your machine’s EPA/DOT status, review its title and bill of sale, and confirm its eligibility before it moves.

Step 2: Pre-Shipment Preparation

We coordinate all origin-site logistics. This includes managing the mandatory USDA steam cleaning, as well as any specialized crating, packing, or securing required for high-value assets.

Step 3: Global Transport & Logistics

Whether your asset requires a time-critical Air Freight Charter, specialized Ro-Ro (Roll-On/Roll-Off) shipping for wheeled cargo, or a Breakbulk vessel for over-dimensional units, we manage the whole transport from the supplier’s site to the U.S. port.

Step 4: Customs Clearance & Final Delivery

Our in-house licensed customs brokers handle the formal entry. We manage complex documents, file the correct Harmonized Tariff Schedule (HTS) classification, and pay all duties and taxes. Once released by CBP, our heavy-haul team coordinates the final delivery to your project site or production line.

Calculate Import Duty in Minutes!

Understanding the True Cost: Duties, Tariffs, and Taxes

Budgeting to import machinery involves two distinct categories of cost: project logistics and government-imposed fees.

Project Logistics Costs

These are the costs managed by Atlantic Project Cargo for the physical move, including:

- Air or Ocean Freight (Charter, Breakbulk, Ro-Ro)

- Inland Heavy-Haul (at origin and destination)

- Port handling, crating, and steam-cleaning fees

- Our project management and customs brokerage service fees

- A U.S. Customs Bond (required for all commercial imports)

Governmental Costs (Paid to CBP)

These costs are set by law and can be significant. The duty owed depends on the machine’s value, country of origin, and classification.

- Standard duty: Varies by product. For example, passenger cars have a 2.5% base duty

- The “chicken tax”: This is a long-standing 25% tariff on imported light trucks

- Section 232 tariffs: In recent years, these tariffs have added a 25% duty on many commodities, which can apply to equipment made primarily of steel or aluminum, especially from non-FTA (Free Trade Agreement) countries

- Gas guzzler tax: An IRS tax on certain imported passenger cars with low fuel-economy ratings

The 25-Year Exemption: A Key Exception

There is a major official exception applicable to importing machinery from other countries, which is classified as antique equipment.

- DOT: A vehicle 25 years or older is exempt from DOT safety standards

- EPA: An on-road vehicle 21 years or older is exempt from EPA emission standards

- Tariffs: Antique vehicles are often exempt from the newer, higher tariffs (like Section 232) and are generally only subject to the original 2.5% duty

This exemption makes older, classic, or specialized machinery much simpler and more cost-effective to import, but the paperwork must be filed correctly to claim the exemption.

Your Partner for Complex Industrial Machinery Import

If you want to import machinery to the USA, you need to understand that it is a high-stakes operation. You are not just moving a box; you are moving a critical asset for your business.

Go beyond standard freight. Atlantic Project Cargo provides true end-to-end project management. Our in-house customs compliance experts work alongside our logistics team from day one to mitigate risk, manage all partners, and provide a single point of accountability from origin to your final destination.

Planning your next big import?

Contact our team today to review your import requirements and build a comprehensive logistics plan.

Email: [email protected]

Calculate Import Duty in Minutes!

Read More