While the global shipping scene took a slight dip in 2022, with maritime trade volumes down 0.4%. The robust 2.4% rebound in 2023, with the trend continuing through 2028, boasting consistent growth above 2% according to UNCTAD’s Review of Maritime Transport 2023.

Over 11 billion tons of cargo is shipped annually, representing 80% of the supply chain. However, research shows that shippers lost an average of 661 (0.026%) containers in 2022.

Thus, to avoid this, successful traders must create comprehensive shipment plans to identify how their cargo will reach the final destination, who will pay for losses and damages, and what costs fall into the exporter and importer’s responsibility. Shipping Incoterms are standardized rules and regulations that help you answer these questions!

With these internationally recognized, exporters and importers can enjoy a smooth, seamless, and error-free transaction. Below, we’ll explore the 11 Incoterms and how they benefit sellers and buyers.

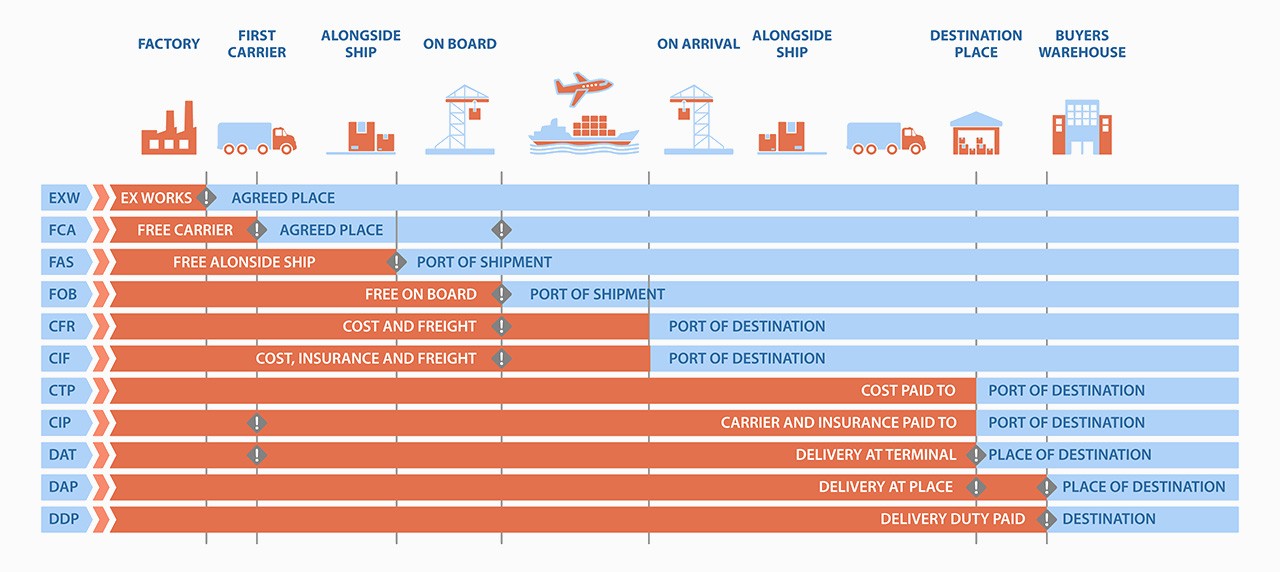

Incoterms Rules for All Transportation Modes

Carriage & Insurance Paid (CIP)

CIP indicates that the seller will cover the shipping and insurance costs. Once the shipment reaches the pre-determined destination, the cargo transfers to the buyer, making them responsible for the rest of the shipping process. With CIP, the International Chamber of Commerce requires sellers to buy freight insurance.

Carriage Paid To (CPT)

CPT shipping terms designate the shipping costs and unloading responsibilities to the seller. However, the buyer must unload the cargo at the defined delivery spot and transport it to its final destination. The seller is not responsible for procuring insurance.

Delivered at Place (DAP)

In DAP, the sellers must deliver the goods to their final destination. The sellers are responsible for any terminal costs. Also, the seller’s responsibilities include packing, export clearance, and carriage expenses, Next, the buyer has to unload the shipment and pay for customs clearance, import duty and taxes.

Delivered Duty Paid (DDP)

With DDP, sellers are responsible for the cargo’s delivery to a determined location, including clearing taxes & duties, and clearances. Also, the seller is responsible for getting authorizations and registrations from authorities. After that, the responsibility shifts to the buyer, who must unload the shipment and cover relevant costs.

Delivered at Place Unloaded (DPU)

DPU (previously known as Delivered at Terminal – DAT) terms that sellers must carriage, deliver, and unload the cargo at its final location. The seller must pay export fees, carriage, unloading from the carrier, and port charges at the final destination. Once done, the buyer is responsible for clearing taxes, customs clearance, and import duties. Local transportation fees to the final destination are also paid by the buyer.

Ex-Works (EXW)

Under EXW, the seller’s obligations are minimal. They simply need to make the goods available at their own premises or another designated location, such as a factory, office, or warehouse.

Once the goods are at the designated location, ownership is transferred to the buyer. This means the buyer assumes all costs and risks associated with the goods from that point forward.

Free Carrier (FCA)

Under FCA, the seller’s obligations focus on delivering the goods to a specific location designated by the buyer. The seller’s obligations involve loading the goods onto the buyer’s chosen transportation or simply making them available for collection at the nominated terminal. Also, the seller must prepare and obtain all necessary export documentation and comply with security regulations for the goods’ departure from their country.

The critical point of risk transfer occurs when the goods are loaded onto the buyer’s designated transportation. From that moment onwards, the buyer assumes all risks associated with the goods, including any damage or loss that may occur during their journey to the final destination.

The buyer bears the financial responsibility for transporting the goods, any fees associated with issuing bill of lading, insurance, and unloading the goods.

Customs Clearance Guide

Download your copy today and: • Navigate customs with confidence • Save time and money • Stay compliant

Stop the guesswork, start streamlining your imports and exports. Download your free guide now!

Download nowIncoterms Rules for Sea and Waterway Transportation

Cost Insurance and Freight (CIF)

With CIF, the seller must pay for the shipping and insurance costs. Any damage or loss on board of the ship is a responsibility of the seller. Export clearance and Once the goods arrive at the requested port, the buyer is responsible for covering unloading and importing expenses.

Cost and Freight (CFR)

CFR requires the seller to pay for and arrange the carriage of goods to the buyer’s designated port of destination. Export clearance and freight costs are the seller’s responsibility. The seller is liable for any damage or loss that occurs during the shipment. CFR does not mandate the seller to arrange insurance. The buyer is responsible for all costs associated with unloading and transporting the goods from the arrival port to their final destination. Buyer is advised to purchase appropriate insurance coverage.

Free Alongside Ship (FAS)

FAS requires the seller to handle the export process until the goods reach the carrier vessel. After that, the buyer is responsible for the cargo’s loading, costs, and risks.

Free on Board (FOB)

Under FOB, the seller’s obligations and associated costs cease upon loading the goods abroad on the buyer’s nominated vessel at the agreed-upon port of shipment.

The seller is responsible for delivering and loading goods onto the vessel at the buyer’s expense. Also, the seller handles export clearance.

The buyer assumes all post-shipment costs, including marine freight charges, bill of lading fees, and any desired insurance for the goods. The buyer manages to unload at the arrival port and any subsequent inland transportation. Once onboard the vessel, any damage or loss to the goods becomes the buyer’s responsibility.

Understanding Incoterms 2020

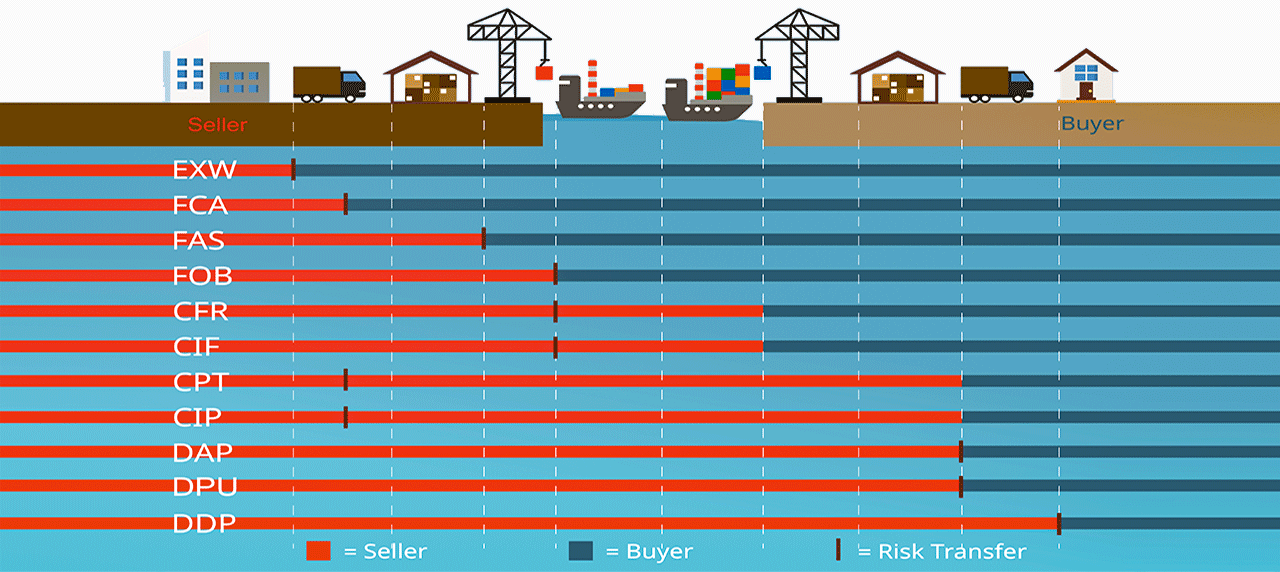

Risk Transfer and Enhanced Security in Incoterms 2020

The 2020 edition of Incoterms introduces a significant advancement in defining the precise point of risk transfer in international trade transactions. This transition of responsibility for potential loss or damage to goods from seller to buyer is now clearly demarcated within each Incoterm rule, fostering greater clarity and stability for trade finance entities.

Beyond risk transfer, Incoterms 2020 prioritizes security by explicitly outlining import and export requirements. This enhanced transparency clarifies which party, buyer or seller, is responsible for fulfilling each specific regulation. These detailed mandates offer enhanced risk mitigation and streamline compliance processes.

Categorization and Key Updates

The updated structure categorizes Incoterms into two distinct groups, one of each major mode of transport (maritime, air). This facilitates easier selection of the appropriate Incoterm for individual trade scenarios.

One of the most notable changes involves the FCA (Free Carrier) term. Under Incoterms 2020, buyers can now instruct carriers to issue Bills of Lading with onboard notations to the seller. This feature, crucial for satisfying Letter of Credit conditions, previously favored the utilization of FOB(free on Board) by exporters. However, FCA’s inherent suitability for containerized goods due to its lower overall cost compared to FOB remains advantageous.

Furthermore, the replacement of DAT (Delivered at Terminal) with DPU (Delivered at Place Unloaded) clarifies a previously ambiguous term. DPU’s broader scope encompasses all delivery options, regardless of location, eliminating potential confusion.

For CIP (Carriage and Insurance Paid) insurance coverage requirements are enhanced. Sellers are now obligated to procure a higher level of insurance under Institute Cargo Clause A, amounting the 110% of the invoice value. The increased coverage, more appropriate for manufactured goods, offers greater protection against potential losses. Conversely, CIF (Cost Insurance & Freight) for commodity shipments maintains its existing Institute Cargo Clause C insurance stipulations.

Incoterms 2020 also acknowledges the growing trend of self-arranged transport by buyers and sellers. FCA, DAP (Delivered at Place), DPU, and DDP now explicitly address scenarios where parties manage their logistics rather than relying on third-party carriers.

Finally, cost allocation between buyer and seller is presented with greater precision. This improved clarity mitigates ambiguity surrounding expense responsibility, a frequent source of concern in the 2010 Incoterms edition, where back charges and unforeseen terminal handling fees occasionally burdened sellers.

In conclusion, Incoterms 2020 represents a significant evolution in international trade regulations, offering enhanced clarity, security, and flexibility for all participants in the global market.

What Are the Differences Between Freight Collect and Prepaid?

Freight Collect and Prepaid are common international freight terminologies. The phrase “Freight Collect” refers to the following four Incoterms that require buyers to cover freight charges: EXW, FAS, FCA, and FOB. Contrarily, “Freight Prepaid” involves the seller paying for the shipping costs, including: CIF, CIP, CFR, CPT, DAP, DDP, and DPU.

Who Decides Incoterms Rules?

Incoterms are international trade terms that reflect the latest global trade processes. So, the International Chamber of Commerce Commission updates these rules every ten years with a party of specialized experts from numerous fields.

What Are the Benefits of Using Incoterms?

Incoterms create a binding agreement between the buyer and seller, outlining the responsibilities, costs, and risks. Companies can ensure seamless communication and avoid role confusion with these standardized terminologies.

Knowing your responsibilities under each Incoterm allows for better cost estimation and budgeting. You can negotiate and secure the best shipping rates when you understand who’s responsible for which leg of the journey. Additionally, Incoterms help allocate risk more fairly, ensuring both parties know who bears the burden of damage or loss during transport.

Incoterms are recognized by courts and legal professionals worldwide. This means that if a disagreement arises, you have a clear legal framework to resolve it, saving you time, money, and legal fees.

Language barriers can complicate international trade, so using globally recognized terms can simplify the transfer of goods. Besides, Incoterms facilitates cost and liability management to ensure a successful and error-free shipping process!

What Are Incoterms Responsibilities?

As discussed, not all Incoterms are applicable for all types of transportation. Thus, knowing which Incoterms are valid for inland waterway, land, air, and sea transport is crucial to cover risks, expenses, and liabilities.

Remember the Incoterm mentioned above division to avoid confusion and ensure successful international shipment.

Types of Insurance Sellers' Need

CIF and CIP Incoterms require sellers to obtain freight insurance before shipment. Both terms have unique requirements, which includes:

- CIP requires sellers to purchase insurance with the Institute Cargo Clause A coverage

- CIF Sellers must obtain freight insurance with a minimum Institute of Cargo Clause C coverage

How Do Buyers and Sellers Determine the Ideal Incoterm?

Most sellers select Incoterms that match their and the buyer’s unique needs. However, buyers can communicate with the trader to agree on the best Incoterm for their cargo.

Moreover, sellers should list the terms on the purchase agreement, contracts, and invoice for Incoterms to be valid. However, no additional documentation or forms are required for selecting an Incoterm.

What's Not Included in Incoterms –things to Be Aware of as a Buyer

Incoterms are crucial to highlight the responsibilities of the buyer and sellers during overseas transportation. However, these rules do not cover everything:

- Do not identify the sale’s condition, types of foods, and contract price

- Don’t outline when ownership of the cargo shifts from the seller to the buyers

- Will not specify the documentation sellers must provide to the buyer for customs clearance

- Do not define the liability for the failure to provide the cargo on time or dispute resolution strategies

Knowing Incoterms and their application in international trading ensures an error-free and successful shipment. Moreover, these terms can change, making it essential for exporters and importers to stay up-to-date.

Atlantic Project Cargo takes the hassle of selecting the best Incoterms off your shoulders with its expert freight transportation service providers! Visit our website to enjoy a seamless international trading process.

Read More