Key Takeaways

- A customs bond is a financial guarantee that importers will fulfill their obligations, covering duties, taxes, and regulatory compliance

- Importers can choose between a Single Entry Bond (SEB) for one-time shipments and a Continuous Bond for multiple imports over 12 months

- Most commercial imports over $2,500 require a bond. Failing to secure one can lead to delays, penalties, and supply chain disruptions

- Underestimating bond coverage, delayed approvals, and non-compliance with CBP regulations can create costly delays

This article will explain the customs bond definition, the types of bonds available, when you need them, and some information about Atlantic Project Cargo.

Calculate Import Duty in Minutes!

Customs Bonds in 2025: What Should You Know About Them

For anyone involved in the import or export world, 2025 promises a landscape of change. New regulations, fluctuating trade winds, and evolving security protocols will undoubtedly impact the smooth flow of goods across borders. But amidst this flux, one element remains constant: the critical role of customs bonds.

Whether you’re a seasoned veteran of the global trade game or a budding entrepreneur venturing into uncharted territory, understanding customs bonds is no longer optional. They are the financial linchpins that secure your compliance with customs regulations, protecting both you and the government from unforeseen hiccups.

But navigating the intricacies of U.S. customs bonds can be daunting. What types are there? Which one applies to your needs? Don’t worry we will clear this topic for you.

What is a Customs Bond?

In the realm of international trade, a customs surety bond serves as a silent guardian, ensuring the smooth flow of goods across borders and protecting the interests of both governments and importers. For medium and large businesses in the US, understanding the role of customs bonds is crucial for successful and compliant import operations.

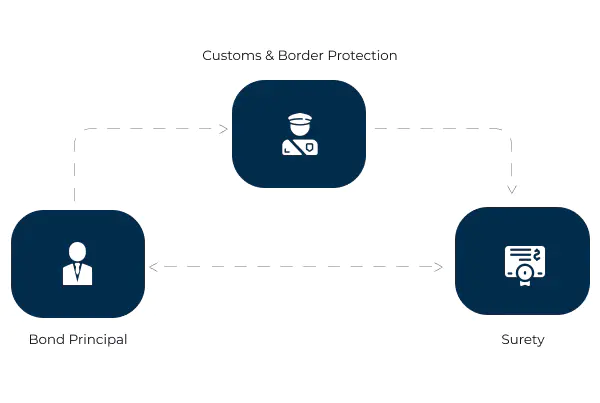

Put simply, a US customs bond is a legal agreement between three parties:

- Importer – is responsible for fulfilling import obligations

- Surety – a company that guarantees payment to Customs and Border Protection (CBP) if the importer fails to meet their obligations

- CBP – the US government agency responsible for regulating imports and collecting duties

Types of Customs Bonds

Not all customs bonds are created equal. The specific type of bond you’ll need depends on the nature of your imports and business activities. Here are the common CBP bond types to be aware of:

- Single Entry Bond (SEB) – Covers a single import entry

- Continuous Bond (Annual Bond) – Covers multiple import entries over 12 months, often the preferred choice for regular importers

Common Customs Bond Activity Codes

- Activity Code 1 – Import Bond. This ensures compliance with import laws and payment of duties/taxes

- Activity Code 1A – Drawback Payment Refunds Bond. It ensures that the claimant properly follows the drawback process and repays any overpaid refunds if required

- Activity Code 2 – Custodian of Bonded Merchandise Bond. For bonded warehouse operators, cartage firms, container freight stations, and other custodians of goods under CBP control

- Activity Code 3 – International Carrier Bond. Required for airlines, vessels, railroads, and truck carriers transporting goods across US borders

- Activity Code 4 – Foreign Trade Zone (FTZ) Operator Bond. Required for operators of FTZs, which are designated areas for duty-free storage or manufacturing

- Activity Code 11 – Airport Security Bond. For entities operating within airport customs security zones

- Activity Code 16 – Importer Security Filing Bond. Mandatory security program for ocean-borne cargo shipments entering the United States

Note: ISF Bond and Entry Bond — are essential for smooth customs clearance and avoiding potential delays or penalties

Choosing the right type depends on your specific import frequency and needs. It’s always best to consult with a licensed customs broker such as Atlantic Project Cargo.

Get Your Free Quote Today!

Understanding Liability and Consequences

While U.S. customs bonds serve as a protective measure, it’s important to remember that they come with financial liability. If you fail to meet your import obligations, such as paying duties or complying with regulations, the surety may be required to pay CBP on your behalf. This could lead to claims against you or your business.

When is a Customs Bond Required?

Generally, if your business imports goods:

- For most commercial shipments valued at $2,500 or more, a bond is required. However, exceptions exist for certain types of goods or frequent importers with continuous bonds

- Required for importers without another valid continuous bond covering ISF or using Single Transaction Bonds (STBs) for each ISF filing.

How Much is a Customs Bond?

In most cases, your bond amount must be at least 10% of the total duties and taxes on your imports. The minimum amount is typically $50,000, but the port director can set a higher amount based on risk assessment.

A customs bond is required to secure their release from CBP custody. This ensures that duties and taxes are paid, and regulations are followed.

Complying With Customs Regulations

Beyond financial obligations, customs bonds also play a role in ensuring compliance with various import regulations, such as:

- Intellectual property rights enforcement

- Anti-dumping and countervailing duties

- Food and drug safety standards

- Environmental protection measures

- Avoiding Penalties and Delays

Failure to obtain one when required can lead to significant penalties, delays in the release of your goods, and potential disruptions to your supply chain.

What Could Trip You Up?

There are several pitfalls that you might have while interacting with CBP and bonds in general. Let’s have a look at the most common ones.

Ensuring Enough Coverage

One common challenge businesses face is underestimating the import bond amount needed, leading to potential liability issues. It’s crucial to accurately calculate the value based on your expected import volume and value

Bond Approval Headaches and Streamlining the Process

Navigating the application and approval process can be time-consuming and complex, especially for businesses new to import regulations. Understanding the requirements and working with experienced partners can help streamline the process

Compliance Pitfalls: Staying on the Right Side of CBP

Staying compliant with CBP’s extensive regulations is essential to avoid bond claims and penalties. This includes timely payments, accurate documentation, and adherence to import procedures

While Atlantic Project Cargo offers customs brokerage services as part of our additional services, we are not primarily a customs broker. Our core expertise lies in freight forwarding: managing the logistics of international cargo shipments, including multimodal transportation, packing, and insurance.

How Atlantic Project Cargo Can Help?

Atlantic Project Cargo is a US-based freight forwarder specializing in the global shipping of heavy and oversized equipment. The company is a leading player in agricultural and construction equipment logistics, known for their expertise in:

- Multimodal transportation – Offering air, ocean, road, and rail solutions for your bulky cargo

- Bespoke door-to-door service – Catering to your specific needs with customized supply chain solutions

- Extensive network – With 11 warehouses across North America and over 100 vehicles, they ensure efficient storage and drayage

- Experienced team – Professionals handle heavy equipment shipping with a focus on safety and reliability

- Comprehensive services – Cover everything from export rigging and crating to HAZMAT transport and humanitarian aid logistics

Whether you’re shipping tractors to India or yachts to Europe, Atlantic Project Cargo can handle it all, making them a trusted partner for complex and oversized freight needs.

Choosing the Right Bond for Your Needs

At Atlantic Project Cargo, we understand the intricacies of customs bonds and their impact on your business success. Our team of seasoned import specialists can help you:

- Navigate the different types and choose the one that best suits your specific needs and import volume

- Accurately calculate the required amount to ensure proper financial coverage and avoid compliance pitfalls

- Complete the application process efficiently, eliminating paperwork headaches and potential delays

Saving Time and Resources

Our streamlined processes and strong relationships with surety companies allow us to secure competitive rates and expedite the approval process, saving you valuable time and resources.

Navigating Customs with Confidence

We aren’t here for a one-time transaction. We’re your trusted partner throughout your import journey. We offer ongoing support and guidance, including:

- Compliance updates and consultations to keep you informed about changes in CBP regulations

- Customs audits assistance to ensure smooth and risk-free interactions with CBP

- Trade finance solutions to optimize your cash flow and manage import costs effectively

Why Choose Atlantic Project Cargo?

Partnering with Atlantic Project Cargo means gaining access to:

- Experienced professionals with extensive expertise in shipping bonds and US import regulations

- Competitive rates due to our strong relationships with surety companies

- Time-saving solutions that streamline the import bond procurement and compliance process

- Ongoing support and guidance to navigate the ever-changing world of customs regulations

Don’t let a CBP bond become a stumbling block in your import operations. Contact Atlantic Project Cargo today for a free quote and unlock a seamless import experience. Our dedicated team is ready to be your trusted partner in navigating the maze of customs regulations and ensuring your business success.

An import bond, also known as a customs bond, is a financial guarantee required by US Customs and Border Protection (CBP) to ensure that import duties, taxes, and fees are paid.

To obtain a customs bond, you need to:

- Determine whether you need a Single Entry Bond or a Continuous Bond

- Contact a licensed customs broker who can issue the bond

- Provide necessary information about your shipment

- Pay the required bond

Continuous Bond covers all imports for a 12-month period, making it ideal for frequent importers. Single Entry Bond covers a one-time shipment and is based on the value of the goods plus duties, taxes, and fees.

ISF Bond is required for Importer Security Filing (ISF) for ocean shipments arriving in the US. It ensures the timely filing of ISF data with CBP. Customs Bond is required for goods to be released by CBP, ensuring payment of duties, taxes, and compliance with regulations.

Read More