What is a Trade Deficit?

In this article, we will have a look at the concept of trade deficits, exploring what they are, how they’re categorized, and the various factors that cause them. We will clarify common misconceptions surrounding trade deficits and highlight the importance of understanding the underlying reasons behind them to assess their true impact on a country’s economic well-being. Moreover, we will discuss the complexities of bilateral vs. overall deficits and the unique situation of the U.S. dollar as the world’s reserve currency.

Deficit in trade is a situation when a country’s imports are higher than exports. This means the nation is buying more goods and services from other countries than it’s selling to them, resulting in a negative balance of trade.

Deficit in trade is a situation when a country’s imports are higher than exports. This means the nation is buying more goods and services from other countries than it’s selling to them, resulting in a negative balance of trade.

While it does reflect international trade activity, it’s not the sole indicator. It focuses specifically on the imbalance between a country’s imports and exports.

Categorizing Trade Deficits

Trade deficits can be calculated for various categories. This includes:

- Goods

Physical products a country imports and exports (e.g., cars, clothing, machinery) - Services

Activities a country provides to other countries (e.g., tourism, banking, education)

International Transactions

Trade deficits are just one aspect of a broader concept: the balance of payments. This comprehensive record tracks all financial transactions between a country’s residents and non-residents. It includes:

- Current Account

This captures the flow of goods, services, income, and current transfers. Trade deficits are reflected here - Financial Account

This tracks foreign investment activity (loans, purchases of stocks and bonds) - Capital Account

This covers financial transfers related to non-produced assets (e.g., grants, inheritances)

Negative balances in specific accounts within the balance of payments contribute to a trade deficit.

Causes of Trade Deficit

This situation arises from a complex interplay of factors influencing a country’s trade patterns.

- Consumer Preferences

A country’s citizens might simply prefer imported goods over domestically produced ones. This could be due to factors like price, quality, or brand recognition - Exchange Rates

A strong currency makes it costlier to sell things abroad (exports) while making foreign goods cheaper to buy (imports). This discourages companies from exporting and encourages more imports, leading to a larger trade deficit - Savings and Investment

If a country saves less than it invests, it might need to borrow from foreign countries. This foreign capital inflow can finance the deficit, as the borrowed money is often used to purchase imports - Global Production Chains

Many products today involve production stages spread across different countries. A country might import components, assemble them domestically, and then export the finished product. This can create a trade deficit even though the country has a strong manufacturing sector - Economic Development Stage

Developing countries often run trade deficits as they import capital goods and technology needed to build their industries. This deficit can be a sign of future growth potential

The Impact of the U.S. Dollar

The United States’ position as the world’s reserve currency, with the U.S. dollar dominating international transactions, adds a unique wrinkle to its trade deficit story.

Global demand for U.S. dollars is significant. Many countries and investors view the dollar as a haven for their savings and investments, creating a constant inflow of dollars. This strong demand for dollars can lead to a trade deficit. If everyone wants dollars, foreign countries might be willing to tolerate a trade deficit with the U.S. just to accumulate those dollars.

It’s important to note that this deficit isn’t a one-way street. Much of the money flowing out due to the trade deficit circles back to the U.S. as foreign investment, particularly in U.S. Treasury bonds. Countries like China and Japan hold trillions of dollars in U.S. Treasuries, essentially financing the deficit.

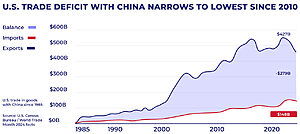

Trade deficits are not static. Consider the impact of fluctuating oil prices. In 2014, when energy prices skyrocketed, the U.S. had a substantial trade deficit with oil-producing nations. However, when energy prices plunged later that year, the deficit narrowed with increased U.S. oil production.

Trade Deficit Misconceptions

The situation where a country imports more than it exports often sparks debate. Let’s clear up some common misconceptions.

The situation where a country imports more than it exports often sparks debate. Let’s clear up some common misconceptions.

Myth #1: Trade Deficits Mean Lost Jobs

While job losses can occur in certain sectors due to increased imports, a trade deficit doesn’t necessarily translate to overall job losses. The economy can create new jobs in other areas, and competition from imports can sometimes encourage innovation and efficiency in domestic industries.

Myth #2: Trade Deficits Hinder Economic Growth

A trade deficit can actually indicate a strong domestic economy. Consumers with healthy disposable income might be driving demand for imported goods. Additionally, a trade deficit can free up resources for domestic investment, potentially fueling future growth.

Myth #3: Trade Deficits Are Always Bad

The impact of a trade deficit depends on the underlying causes. If a deficit is financed by foreign investment in productive sectors, it can be beneficial. However, a deficit fueled by excessive borrowing can raise concerns about long-term economic stability.

Myth #4: Trade Deficits Are Caused Solely by Unfair Trade Practices

While unfair trade practices like currency manipulation can contribute to deficits, they’re not the only factor. Domestic factors like consumer preferences and exchange rates also play a role.

Myth #5: Trade Wars Are the Solution

Imposing tariffs and other trade barriers in response to a trade deficit can backfire. It can lead to higher prices for consumers, hurt exporters, and trigger retaliation from trading partners. Negotiation and addressing underlying issues are often more effective strategies.

Different Deficits

Trade deficits can be a complex topic, and understanding them requires looking beyond simple comparisons between two countries.

Bilateral vs. Overall Deficits

Not all trade deficits are equal. Bilateral deficits, specific to trade between two countries, often arise from comparative advantages. A country might excel in producing certain goods or services, leading to trade imbalances with its partner.

For example, the U.S. has a surplus in services like finance and technology, reflecting its skilled workforce and advanced infrastructure. However, it has a deficit in manufactured goods. This doesn’t necessarily indicate unfair practices; it simply reflects what each country can produce most efficiently.

Trade Policy and Bilateral Deficits

Trade policies may have a limited impact on bilateral deficits. Take the U.S. trade relationship with Germany and the Netherlands, both members of the European Union with similar trade policies towards the U.S. Despite this, the U.S. has a trade deficit with Germany (known for its cars and machinery) and a surplus with the Netherlands (known for medical equipment). This highlights how consumer preferences and specialization drive bilateral trade, not necessarily policy manipulation.

Overall Deficits and Macroeconomics

Overall trade deficits, encompassing a country’s trade with the entire world, involve broader economic considerations. Many economists believe the U.S., with the U.S. dollar as the world’s reserve currency, might naturally run an overall deficit. Here’s why:

- The dollar is used extensively in global transactions, even outside direct U.S. trade. This global demand for dollars can strengthen its value

- A strong dollar can make U.S. goods more expensive compared to those from other countries. This can impact competitiveness in some sectors, particularly manufacturing

- The U.S. excels in exporting services and technology, areas requiring specialized skills. These exports can’t be easily replicated by other countries

When Are Trade Deficits a Problem?

The saying “it all depends” often rings true in economics, especially regarding trade deficits. Whether a deficit is positive or negative depends on the reasons behind it. However, economic theory offers a framework to analyze these deficits effectively.

A trade deficit, where imports exceed exports, can be a sign of:

- Competitiveness Issues – If imports surge due to cheaper or higher-quality foreign goods, it might indicate domestic competitiveness challenges

On the flip side, a deficit can also signal:

- A Thriving Economy – A deficit can sometimes reflect high levels of investment exceeding domestic savings. This investment can fuel economic growth and future productivity

However, the story doesn’t end there. The cause of the deficit matters:

- A deficit fueled by excessive government spending or consumer borrowing can be unsustainable

- A deficit due to increased investment in productive sectors, like infrastructure or technology, can be a positive sign

- Unexpected events like recessions or demographic shifts can lead to temporary deficits

Without understanding the root cause, simply labeling a deficit as “good” or “bad” is misleading. Instead, economists focus on analyzing the underlying trends:

- Competitiveness

Is the deficit due to a decline in domestic industries, or simply increased consumer preference for foreign goods? - Investment vs. Savings

Is the deficit financing productive investment or unsustainable consumption? - Temporary Factors

Are there external shocks impacting the deficit, such as a global recession or an aging population?

By analyzing and breaking down these factors, economists can better understand a trade deficit and its implications for a specific country’s economic health.

Conclusion

Trade deficits can be a complex economic phenomenon, and their impact depends heavily on the underlying causes. This article has unpacked the concept, exploring how deficits arise, the various misconceptions surrounding them, and the factors that influence their significance.

By analyzing the reasons behind a trade deficit – competitiveness issues, investment levels, or temporary external factors – economists can provide a more accurate assessment of its implications for a country’s economic well-being.

Read More